Corporate Finance Process

The Process:

There are typically three major challenges that business owners face:

1. You need to create a unique business plan that targets the right market niche in order to increase your reach and revenue.

2. You are undecided or overwhelmed with information and ideas, and are looking for a qualified expert to help you implement the right action plan to start your business or take it to the next level.

3. You understand what needs to be done to run your business, but you need the right business model in order to efficiently serve your clients/customers/members with the right systems and structures in place.

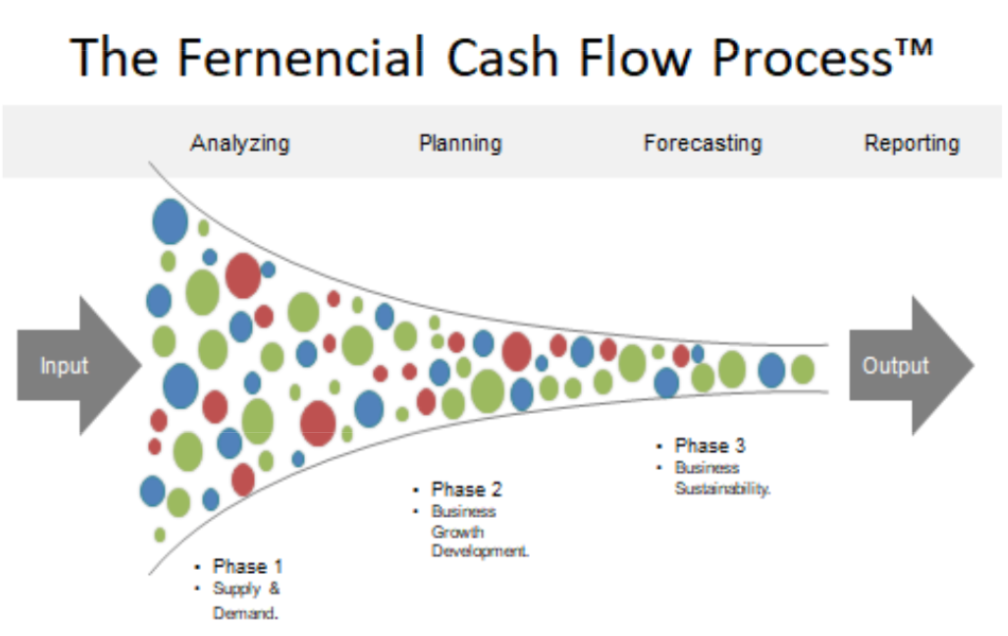

Fernencial Corporate Finance (FCF) meticulously studies the organization’s Strengths, Weaknesses, Opportunities, and Threats then implement a streamlined method called “Input/Output Cash Flow Analysis Process” that primarily focuses on protecting the owner’s investment and maximizing the organization’s profitability as well as maintaining a comparative advantage through short term and long-term financial planning and the implementation of various strategies.

The Input/Output Cash Flow Analysis Process serves as a check-up method used on your business’ financial health. It is a thorough and comprehensive study of the movement of cash through your business in order to determine patterns of how you take in and payout money so that Fernencial can implement the right course of action for your business. We believe in transparency, below is the conceptual process:

Business Consulting:

Statistically, 90% of Startup Businesses fail, that’s nine out of ten. Your business’ success does not derive from how hard you work “in” your business but how much you work “on” your business. Fernencial Corporate Finance has a streamlined process to prevent business failures and sustain business stability with a competitive edge.

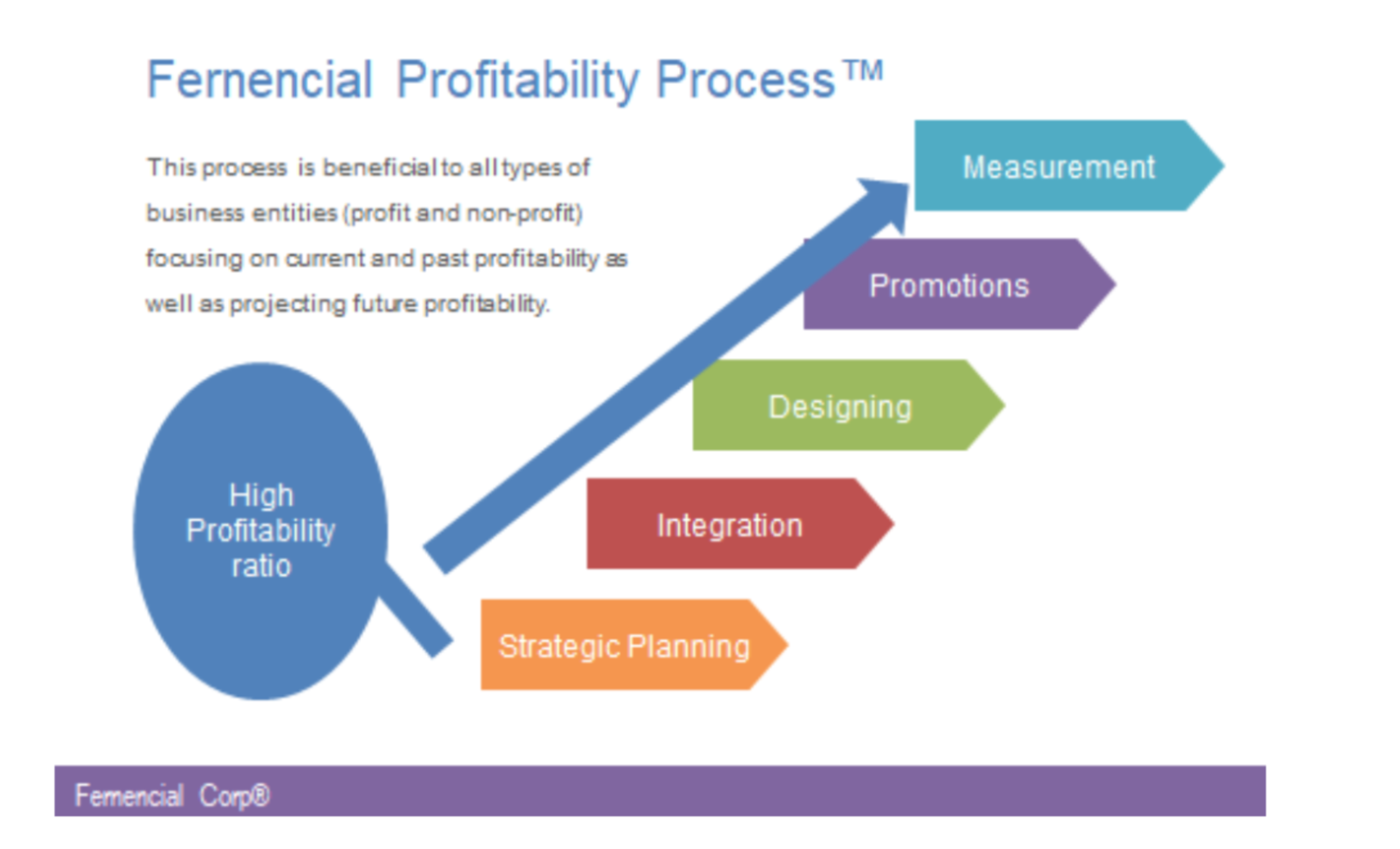

Whether you are a startup or established business, you need Fernencial’s business and/or marketing plan that leverages time and money in order to take your business to the next-level. Our business consulting helps you to: leverage and design an efficient business model, increase revenue and profits, learn marketing and business tools, extend your reach to find your market niche(s), create a cohesive action plan to boost your business, and think strategically about your business vision and projects.

We believe in transparency, below is the conceptual process of our profitability method that will be customized to create specific strategies, methods, plans, structures, systems or tactics for your business or organization:

- Business planning and strategy

- Service/product offerings and pricing strategy

- Business short-term and long-term direction

- Delegation/dealing with staff and sub-contractors method

- Traditional marketing planning

- Internet marketing planning

- Social media marketing

- Project planning

The Business consulting program includes : 90-day period, 10 phone call sessions (60 minutes each), and 10 hours of email support including document review.

If you are ready to take action and improve your new or existing business plan, we offer a free 45-minute telephone/skype conversation in order to determine which program is right for you and your business. Email us today to schedule an appointment: [email protected]

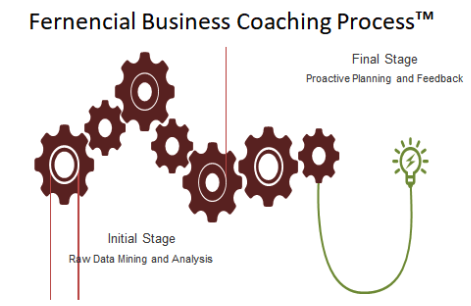

Maintaining a sound and stable business structure

- Planning applicable course of actions.

- Embracing organizational changes

- Mastering time management

- Creating a culture of accountability

- Dealing with self-sabotage

- Supporting system

- Productivity driven

- Improving confidence

- Brainstorming strategic directions

The Business coaching/mentoring program includes: 60-day period, 10 phone call sessions (45 minutes each), and 5 hours of email support including document review. Fernencial Corp is extraordinarily committed to learn about you and your business in order to create an effective coaching plan that supports your business goal(s). If you are ready to take action and improve the health or performance of your new or existing business, we offer a free 45-minute telephone/skype conversation in order to determine which program is right for you and your business. Email today us to schedule an appointment: [email protected]

Personal Finance Process

Fernencial Personal Finance (FPF) primarily focuses on maintaining or improving the “Financial Management Habit” of an individual or a family through proper counseling and hands-on coaching on how to manage, budget, save and spend monetary resources over time, as well as various financial risks and future life events. Fernencial is extraordinarily committed to get to know you and learn about what keeps you motivated to move forward on your tasks, goals, and most importantly your financial dream.

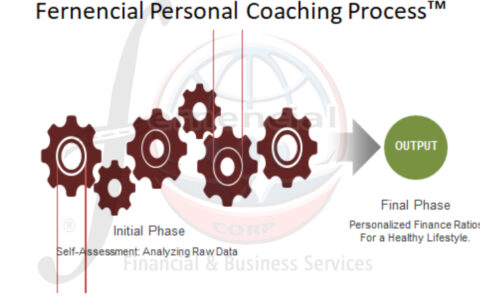

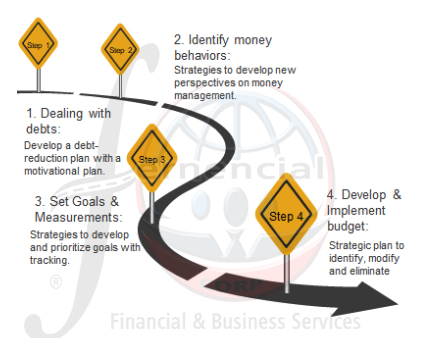

We believe in transparency, below is our conceptual process of fulfilling your Financial Fitness:

Financial Counseling:

Fernencial Personal Finance does not just give financial counseling; it implements a personalized plan that fits your personal financial goal(s) in order to deliver a unique successful result. Our focus is, but not limited to: improve your financial decisions, change unhealthy financial behaviors, facilitate financial decision making, address immediate financial crisis, and achieve defined financial goals. We believe in transparency, below is our conceptual comprehensive financial pathway that leads you to your own personal financial success.

Fernencial Pathway Process

The Personal Financial Counseling program includes: 60-day period, 10 phone call sessions(30 minutes each), and 4 hours of email support including document review.

If you are ready to take action and improve or increase your financial health, we offer a free 30-minute telephone/skype conversation in order to determine your need(s). Email us today to schedule an appointment: [email protected]